Choosing a financial advisor can feel confusing—especially when each firm charges in a different way. Some charge a flat annual fee, others work on a one-time project basis, and many still use the traditional percentage of assets under management (AUM) model.

Each approach has its own strengths and trade-offs. The right choice depends on your financial situation, the level of ongoing guidance you want, and how comfortable you are managing your investments.

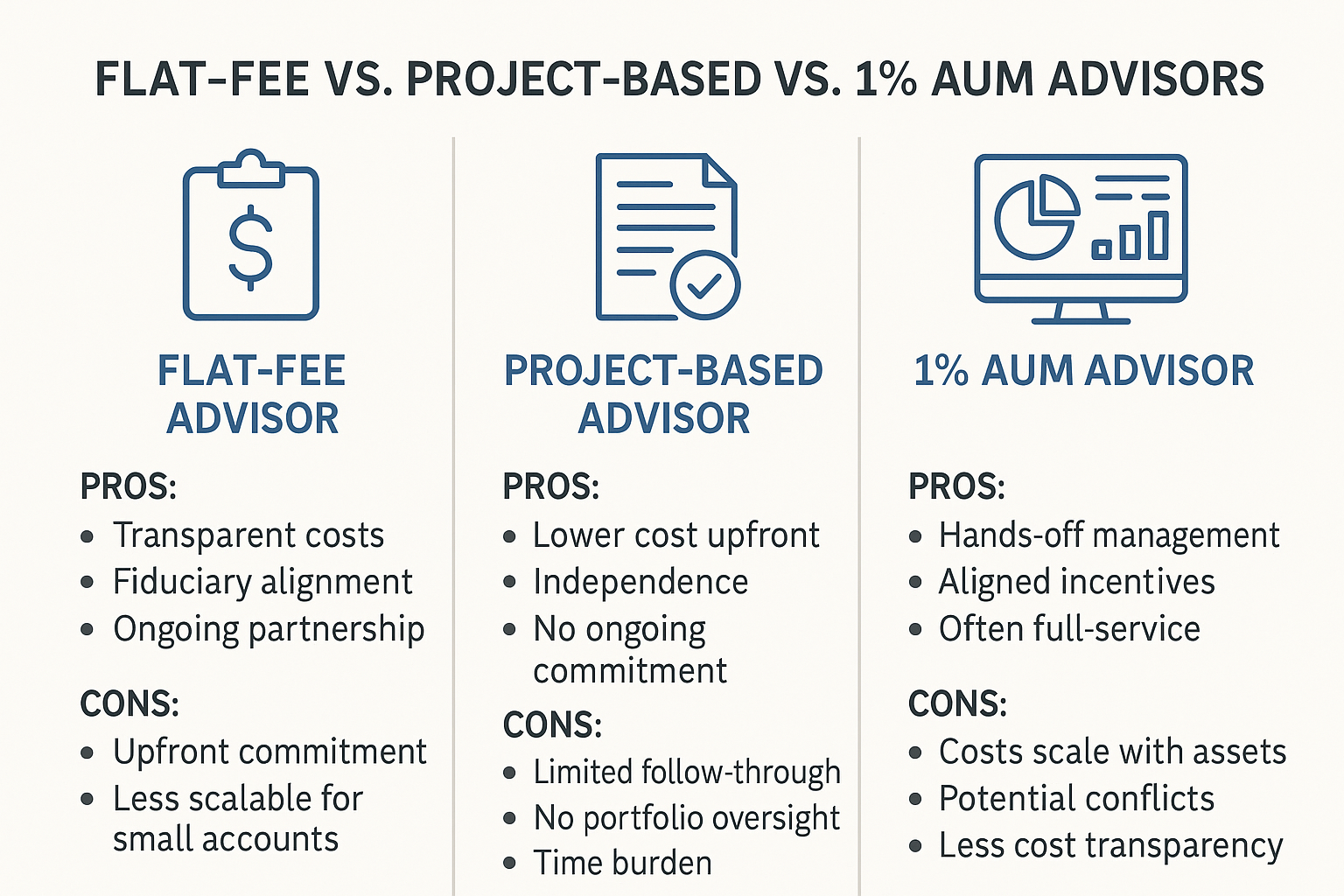

The Flat-Fee Fiduciary Advisor

What It Is:

Flat-fee advisors charge a transparent, fixed annual or monthly fee for comprehensive financial planning and investment management—often regardless of your portfolio size.

Pros:

- Transparent and predictable costs: You know exactly what you’re paying, with no hidden fees or conflicts tied to how much you invest.

- Fiduciary alignment: Because compensation isn’t based on assets, recommendations are more likely to focus on your goals, not your account balance.

- Ongoing partnership: Typically includes continuous financial planning, investment management, and accountability check-ins.

Cons:

- Fee unchanged in down markets: Even if markets decline or your portfolio is small, the fee remains fixed.

- Less scalable for very small accounts: For new investors with limited savings, the flat fee might represent a higher percentage of their assets. Evergreen has an account minimum of $500,000 due to the math on this.

Best Fit:

Individuals or families who want a long-term, holistic relationship with their advisor—covering investments, taxes, retirement, and planning decisions—without paying a percentage of assets.

The Project-Based (Hourly or Plan-Only) Advisor

What It Is:

Project-based or hourly advisors charge a one-time fee for a financial plan or specific guidance (e.g., retirement readiness, stock options, budgeting). They don’t manage assets but instead provide a roadmap you execute yourself.

Pros:

- Lower cost upfront: Great for people who need clarity but not ongoing management.

- Independence: You stay in control of your investments and implementation.

- No ongoing commitment: Pay only for the advice you need, when you need it.

Cons:

- Limited follow-through: Once the plan is delivered, execution and adjustments are up to you.

- No portfolio oversight: Markets and personal circumstances change—without ongoing advice, the plan can become outdated.

- Time burden: Requires a willingness to self-manage and monitor your investments.

Best Fit:

DIY investors or financially confident individuals who want objective advice without a long-term relationship—often professionals or retirees who enjoy managing their own accounts.

The 1% AUM (Assets Under Management) Advisor

What It Is:

The traditional model where an advisor charges around 1% of your investable assets per year to manage your portfolio and provide financial planning support.

Pros:

- Hands-off investment management: Ideal for those who prefer to fully delegate.

- Aligned incentives (to an extent): The advisor benefits when your portfolio grows.

- Often full-service: Includes planning, rebalancing, tax coordination, and behavioral coaching.

Cons:

- Costs scale with assets: As your wealth grows, fees increase—even if the level of service remains similar.

- Potential conflicts: Advisors may be incentivized to keep assets invested rather than recommending debt payoff, charitable gifts, or property purchase.

- Less cost transparency: Fees are deducted from investment accounts, making them less visible.

Best Fit:

Investors who want hands-off portfolio management and are comfortable paying a percentage of assets for convenience and continuity.

Matching the Model to Your Needs

The “best” model depends on your situation:

| Financial Profile | Mode Fit |

|---|---|

| You want long-term guidance, ongoing advice, and flat costs | Flat-Fee |

| You enjoy DIY investing and just need an expert roadmap | Project-Based |

| You want to delegate investments entirely and less sensitive to fee charged | 1% AUM |

Each approach can work well for the right person—it’s about clarity, transparency, and alignment with your goals.