Introduction

For decades, you’ve been working for a paycheck. It arrived every two weeks, like clockwork, giving you the confidence to pay your bills, save for the future, and plan life’s little luxuries.

Now, as you enter retirement, the paycheck stops — but the bills don’t.

For many retirees, replacing that steady paycheck can feel like the biggest financial challenge of all. The goal isn’t just to make your money last, but to make it feel predictable, so you can live your life without constantly worrying about markets or tax surprises.

In this guide, we’ll walk through how to design your own “retirement paycheck” — a sustainable, tax-efficient income plan that balances growth, safety, and peace of mind.

Step 1: Know Your Income Sources

Before building your paycheck, you need to inventory your income streams. Think of this as the foundation.

Common retirement income sources:

- Social Security (timing is critical; more on this later)

- Pension income (if available)

- Withdrawals from IRAs, 401(k)s, or other retirement accounts

- Roth IRA withdrawals (tax-free if rules are met)

- Brokerage accounts (taxable investments)

- Part-time work or consulting

- Other assets that can produce income (business interests, savings, or real estate holdings in areas like Belmont or Lexington)

Pro Tip: List out each source, when it will start, and whether it’s fixed or flexible.

Step 2: Decide on Your Paycheck Schedule

One of the most underrated retirement planning tips: pay yourself on a schedule.

Whether it’s monthly or bi-weekly, a consistent transfer from your “retirement paycheck account” into your checking account brings order to your finances.

How it works:

- Set up a dedicated high-yield savings or checking account as your paycheck account.

- Each month, transfer in the exact amount you’ve budgeted for living expenses.

- Keep the rest invested according to your long-term plan.

This mimics the structure you had while working, making spending more intentional.

Step 3: Use the Bucket Strategy for Stability

Market volatility is a reality. A “bucket strategy” helps shield your paycheck from short-term swings.

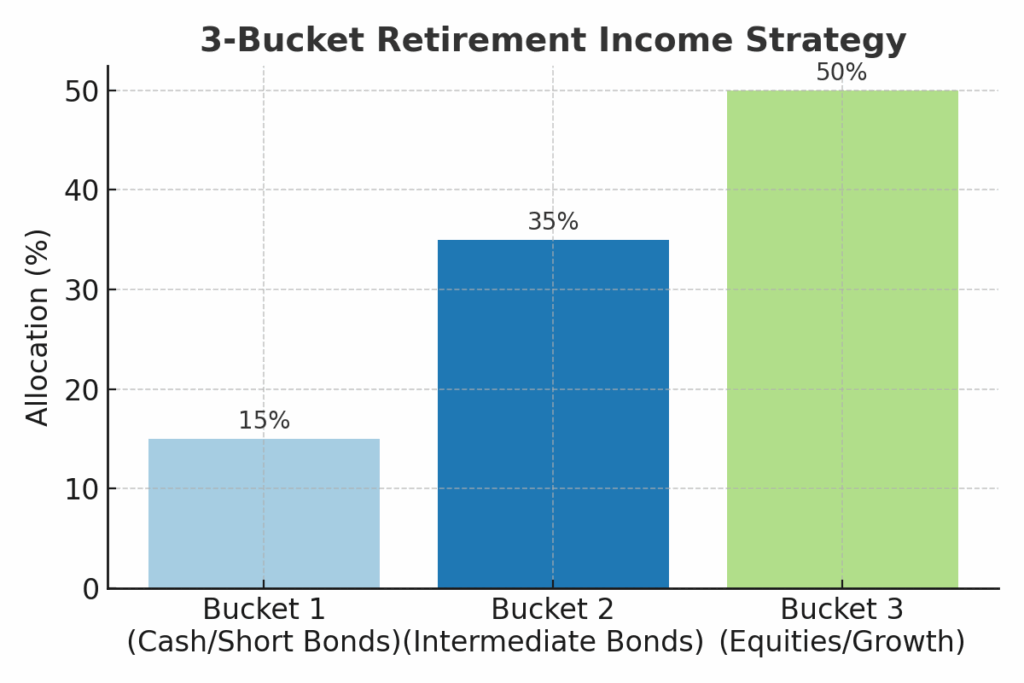

Example 3-Bucket Setup:

- Bucket 1: Cash & Short-Term Bonds – 1–2 years of expenses

- Bucket 2: Intermediate Bonds & Conservative Investments – 3–7 years of expenses

- Bucket 3: Equities & Growth Investments – 7+ years of expenses

When markets are up, you refill Bucket 1 from growth assets. When markets are down, you live off Buckets 1 and 2 until conditions recover.

Step 4: Sequence Withdrawals for Tax Efficiency

The order in which you pull money matters — a lot. Done well, it can reduce your lifetime taxes significantly.

General priority order (varies by client):

- Taxable accounts first – use up capital gains allowances and reduce future taxable income.

- Tax-deferred accounts (IRAs/401k) – balance withdrawals to avoid large RMD tax hits later.

- Roth accounts last – let them grow tax-free as long as possible.

The Pre-Social Security Window

If you retire in your early 60s — say, between 60 and 64 — and don’t start Social Security until 67 or later, you may have a 6–10 year “low income” window where your taxable income is much lower than it will be later.

This is a prime opportunity to:

- Make low-tax withdrawals from pre-tax IRA accounts

- Execute Roth conversions at low tax rates, moving money into a tax-free account for future flexibility

For many Massachusetts retirees, using this window effectively can save thousands in lifetime taxes.

Step 5: Social Security Timing as Part of the Paycheck

Delaying Social Security can significantly boost your lifetime benefits — but only if your other income sources can bridge the gap.

If you wait from age 67 to 70, your benefit can grow by 24% or more.

Example:

- Claim at 67: $3,000/month

- Claim at 70: ~$3,720/month for life

In Massachusetts, where healthcare costs tend to be above the national average, that extra income can provide a crucial cushion.

Step 6: Plan for Inflation and Currency Debasement

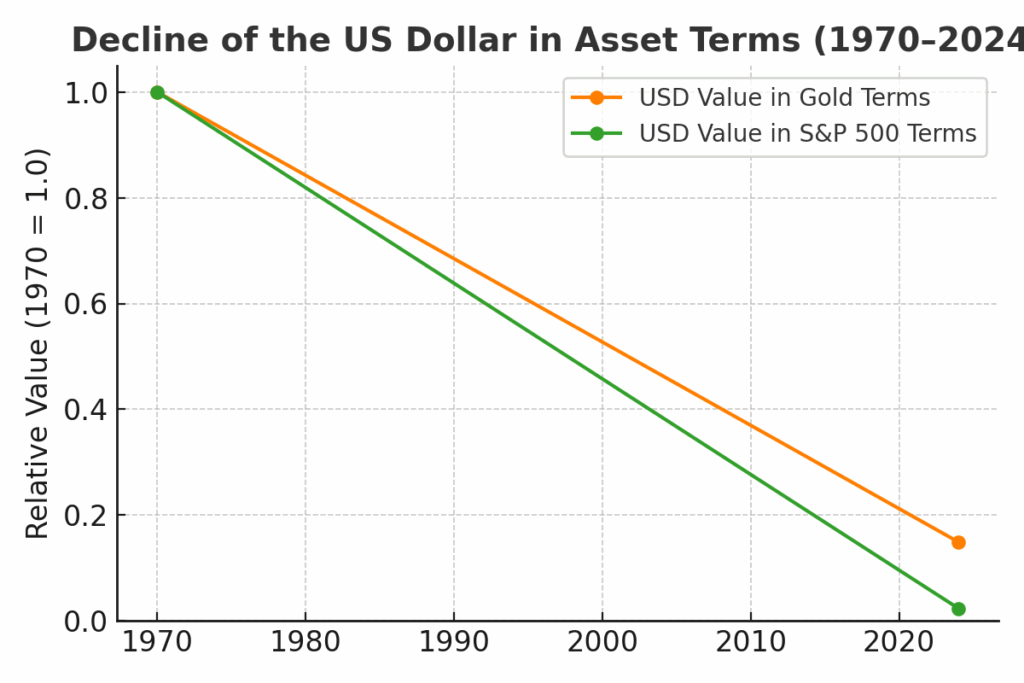

Over a 25–30 year retirement, even moderate inflation can quietly cut your purchasing power in half. Most people think of assets like gold or stocks as “going up” over time — but that’s only one way to look at it. If we flip the perspective and price the U.S. dollar in terms of what it can buy in gold or shares of the S&P 500, its value has fallen dramatically.

The chart below shows the dollar’s value dropping from 1.0 in 1970 to under 0.20 today — meaning the U.S. dollar has lost over 80% of its value compared to these assets over the last 50 years. Many investors worry about the next market downturn and keep large amounts in cash, while minimizing or ignoring the risk of currency debasement.

While it’s wise to keep enough cash to fund near-term lifestyle needs, holding significant amounts in cash for long stretches — seven to ten years or more — can quietly erode wealth in ways that are just as damaging as a market decline.

Protective tools:

- Treasury Inflation-Protected Securities (TIPS)

- Global equity exposure

- Real assets like REITs

- Maintaining growth assets in your portfolio even in retirement

Takeaway: In 1970, one U.S. dollar could buy five times more in gold or stocks than it can today — the dollar’s value has dropped over 80% against these assets.

Step 7: Review and Adjust Annually

Your “retirement paycheck” isn’t a one-and-done plan — it needs to evolve.

Each year, review:

- Spending changes

- Market performance

- Tax law changes

- Life events (health, family needs, moving)

For example, if you downsize from a home in Weston to a smaller condo in Milton, your income needs and tax picture could change significantly.

The Massachusetts Factor

Living in or near Boston comes with unique planning challenges:

- Higher property taxes in certain towns

- Above-average healthcare costs

- Seasonal expenses (utilities in winter, vacation travel in summer)

- Opportunities to tap home equity or relocate within the Greater Boston area to free up capital

Addressing these in your plan helps ensure your paycheck covers not just the basics, but the lifestyle you want.

Conclusion

Creating your own paycheck in retirement isn’t just about numbers — it’s about restoring the comfort and predictability you had while working.

By structuring your withdrawals, managing volatility, and being smart about taxes, you can enjoy your retirement years with confidence.