Fee Structure

Big-Firm Experience. Institutional-Grade Technology.

Built-In Security—With a Common-Sense Fee.

Flat-Fee Fiduciary Wealth Management in Boston — No AUM %, No Commissions, No Surprises

Our flat-fee model mirrors our values:

avoid complexity, eliminate conflicts,

and always put clients first.

At Evergreen Wealth Management, we believe financial advice should be transparent, objective, and conflict-free.

That’s why we operate on a simple flat monthly fee — not a percentage of your assets. You’ll always know exactly what you’re paying and that our guidance is 100% aligned with your best interests.

Work directly with a CFP® fiduciary advisor using the same advanced technology trusted by major institutions — without the sales pressure, hidden incentives, or unpredictable costs.

You’ll also get access to top-tier technology tools for seemless, fiduciary planning:

- eMoney for financial planning and a secure, interactive client portal

- Charles Schwab’s iRebal® for automated, tax-aware portfolio management

- Nitrogen for aligning your investments with your personal risk tolerance

- Holistiplan for detailed tax analysis and uncovering planning opportunities

These tools are backed by institutional-level security protocols, giving you peace of mind that both your plan and your personal information are protected.

And best of all, we offer all of this under a flat, transparent monthly fee of $725. No percentage-based fees. No commissions. No pressure to move assets unnecessarily. Just straightforward, objective advice built around your goals—with clarity, security, and confidence.

Transparent, Flat-Fee Fiduciary Advice – Built for Boston Professionals and Families

A Fee Structure That Puts You First

We charge a flat, all-inclusive fee of $725 per month,

regardless of how much you invest. That means:

Predictable, Transparent Pricing

No AUM %, no hidden fees, no surprises

True Fiduciary Advice

Our only incentive is your success — not selling products or managing assets

No Sales Pressure or Conflicts

You’ll never be pushed to move money or buy investment products

Why a Flat Fee?

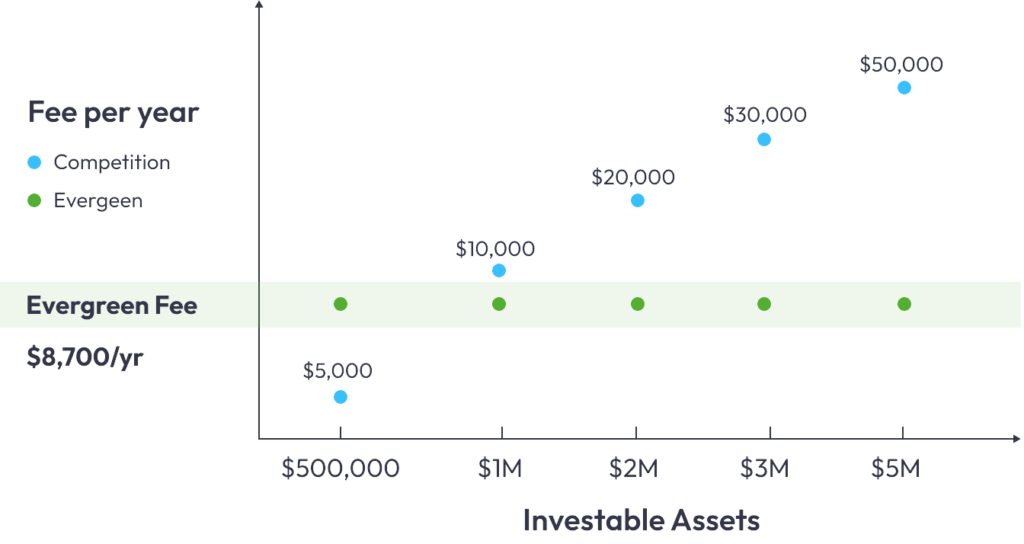

Most financial advisors still charge around 1% of assets under management — a model that rewards gathering assets, not providing better advice.

Under that system, as your portfolio grows, your fees can double or triple without any change in service.

At Evergreen Wealth Management, we believe in a fiduciary, flat-fee approach that keeps your costs predictable and your advisor’s incentives aligned with your goals.

We think there’s a better way — and it starts with transparency.

With larger portfolios can save thousands per year compared to traditional percentage-based pricing.

At $2 million in assets, a typical 1% advisor fee would be about $20,000 annually — while our flat fiduciary fee remains $8,700 per year no matter how much you invest.

What’s Included in Your Fee

Your $725/month flat fee includes everything you need for transparent, fiduciary financial planning and investment management:

- Personalized financial planning using eMoney

- Investment risk alignment with Nitrogen

- Tax return analysis using Holistiplan

- Unlimited access to your advisor for planning

questions and check-ins

- Tax-aware, automated portfolio management with iRebal®

- Ongoing retirement, tax, and withdrawal strategy support

- Secure document sharing and communication tools

- Objective, conflict-free advice—no commissions,

no asset-based sales pressure

Independent, Fiduciary Advice — No Sales Pressure, No Conflicts

We require a minimum of $500,000 in investable assets, held at Charles Schwab. This ensures our flat-fee fiduciary model stays proportional to the value we deliver.

Beyond that, we’re completely independent — we don’t earn commissions, sell products, or require you to move assets under our management.

Our advice is based solely on what’s best for your financial picture — not on where your assets are held.

That flexibility means:

- No pressure to transfer legacy

accounts or specialized assets

- No bias when advising on property sales, pensions, or outside investments

- Full respect for your desire to diversify across institutions

Who We Help – and Who We Don’t

We specialize in flat-fee fiduciary financial planning — providing high-touch, personalized advice without the high AUM-based fees or conflicts of interest found at traditional firms.

This model isn’t for everyone, and that’s okay. Here’s who we typically work best with:

We’re a great fit for:

- Retirees and pre-retirees looking for a long-term fiduciary partner

- Clients who want transparent, flat-fee pricing and modern tools

- Individuals who value objective, commission-free advice

- Professionals who prefer personalized, ongoing guidance

We may not be the best fit if:

- You have under $500,000 in investable assets

- You’re seeking access to private equity or in-house legal/tax teams

- You’re fully confident managing your own finances and future planning

- You want a one-time financial plan without ongoing support

The Fiduciary Difference — Transparent, Flat-Fee Financial Planning

You shouldn’t have to pay more just because your portfolio grew.

With Evergreen, you get transparent, fiduciary advice and one simple flat monthly fee — not a percentage of your assets.

That means no hidden costs, no sales agendas, and no surprises — just clear, ongoing guidance built around your goals.

If you’re ready for a fresh, simplified approach to wealth management, let’s talk.