Tax Planning – Planning Beyond the Return

At Evergreen Wealth Management, we believe tax planning is most effective when it’s integrated into every part of your financial life — not just when you file your return. We take a proactive, year-round approach to help reduce your lifetime tax burden, avoid surprises, and make the most of every opportunity.

Integrated, Not Isolated

Tax planning works best when it’s connected to the rest of your financial strategy. Every decision — investment placement, withdrawal timing, charitable giving, or Roth conversions — carries tax implications. We coordinate your tax strategy with your investment and retirement plans, helping you make smarter choices today and avoid costly surprises tomorrow.

Powered by holistiplan

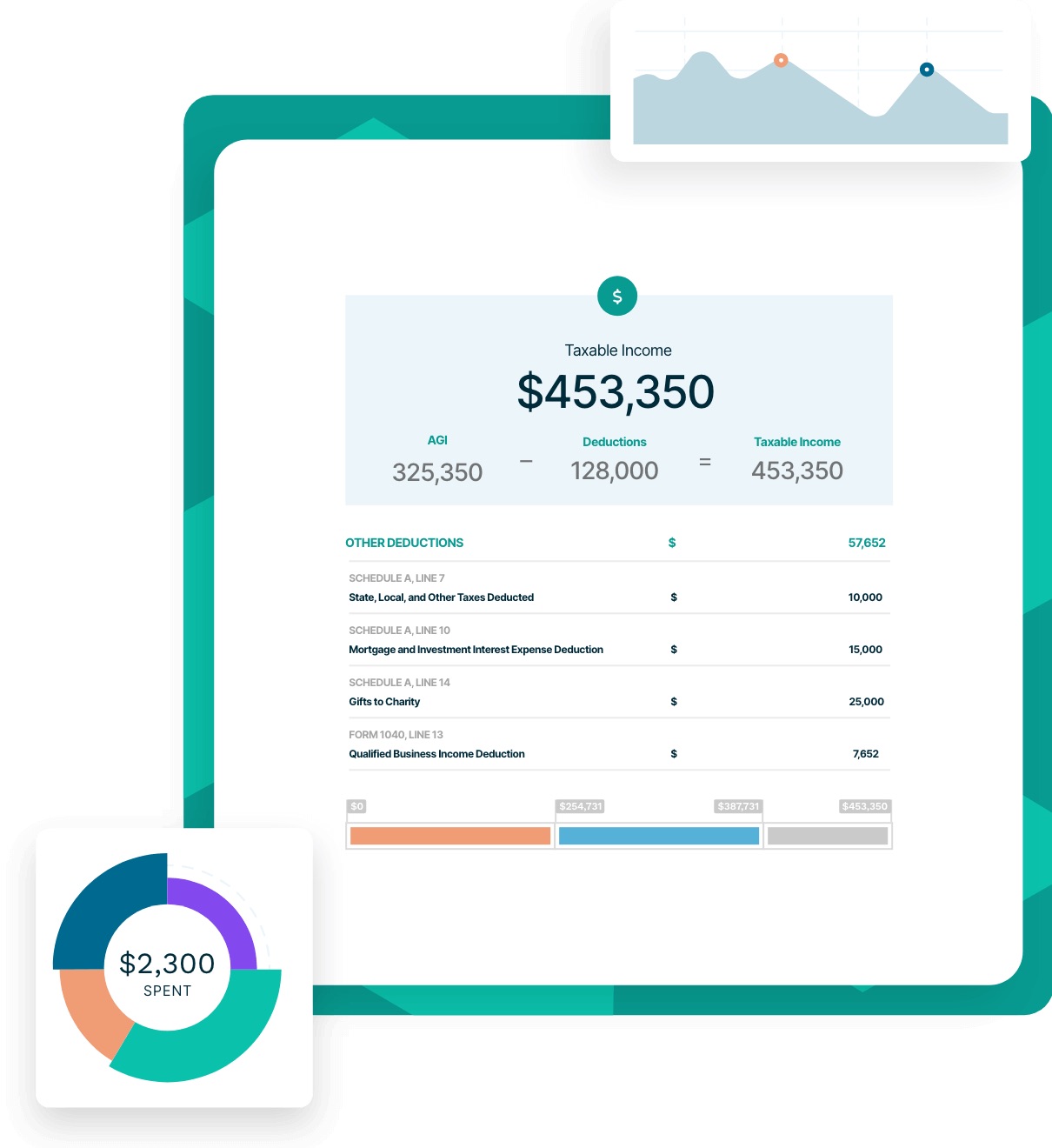

We use holistiplan, an advanced tax analysis platform, to go beyond surface-level planning:

- Upload your tax return to our client portal

- Generate a one-page visual summary of your tax situation

- Spot overlooked opportunities and risk areas

- Model tax-efficient strategies such as Roth conversions, charitable giving, and multi-year bracket management

holistiplan helps us provide clear, actionable insights, turning complex tax data into understandable guidance.

Personalized, Year-Round Tax Planning

We help you reduce taxes not just this year, but over your lifetime.

Key areas we address:

Tax-Efficient Withdrawals:

Coordinate IRA, Roth, and taxable account

distributions to lower your lifetime tax bill.

Roth Conversion Analysis:

Model potential benefits of converting

pre-tax assets to Roth.

Bracket Management:

Avoid “bracket creep” by proactively

managing income.

Charitable Planning:

Evaluate Qualified Charitable Distributions (QCDs) or

Donor-Advised Funds (DAFs) if giving is part of your values.

Collaboration with Your CPA

While we don’t prepare tax returns, we actively collaborate with your CPA to make sure tax-smart decisions are implemented smoothly. Through your secure client portal, we can share reports, documents, and planning recommendations directly with your tax professional.

Part of Every Evergreen Plan

At Evergreen, tax planning isn’t a one-time service. It’s baked into every financial plan and every client relationship. Whether you’re retired, preparing to retire, or just optimizing a portfolio, thoughtful tax planning is a core part of how we help you keep more of what you’ve earned.

Want to know how your current strategy holds up?

Ask us about a complimentary holistiplan tax return analysis.