-

AI vs. Human Advisor: Why the “Modern Advisor” Costs 60% Less (And Does More)

There is a growing trend of investors firing their traditional advisors to go “Full AI” or DIY. Usually, they are doing this for one reason: Fees. If you are paying…

-

The 1% Wealth Tax: How AUM Fees Impact a $1.5M Portfolio Over 30 Years

When you interview a financial advisor, a 1% Assets Under Management (AUM) fee sounds small—almost negligible. But in the world…

-

The 3 Ways to Hire a Financial Advisor

Hiring a financial advisor in 2026 requires looking past titles like “Wealth Manager” or “Fiduciary” and examining the firm’s underlying…

-

Fiduciary, Flat-Fee, or 1% AUM: Understanding How Financial Advisors Really Charge

When most people start looking for a financial advisor, one word comes up again and again: fiduciary. You’ll often hear…

-

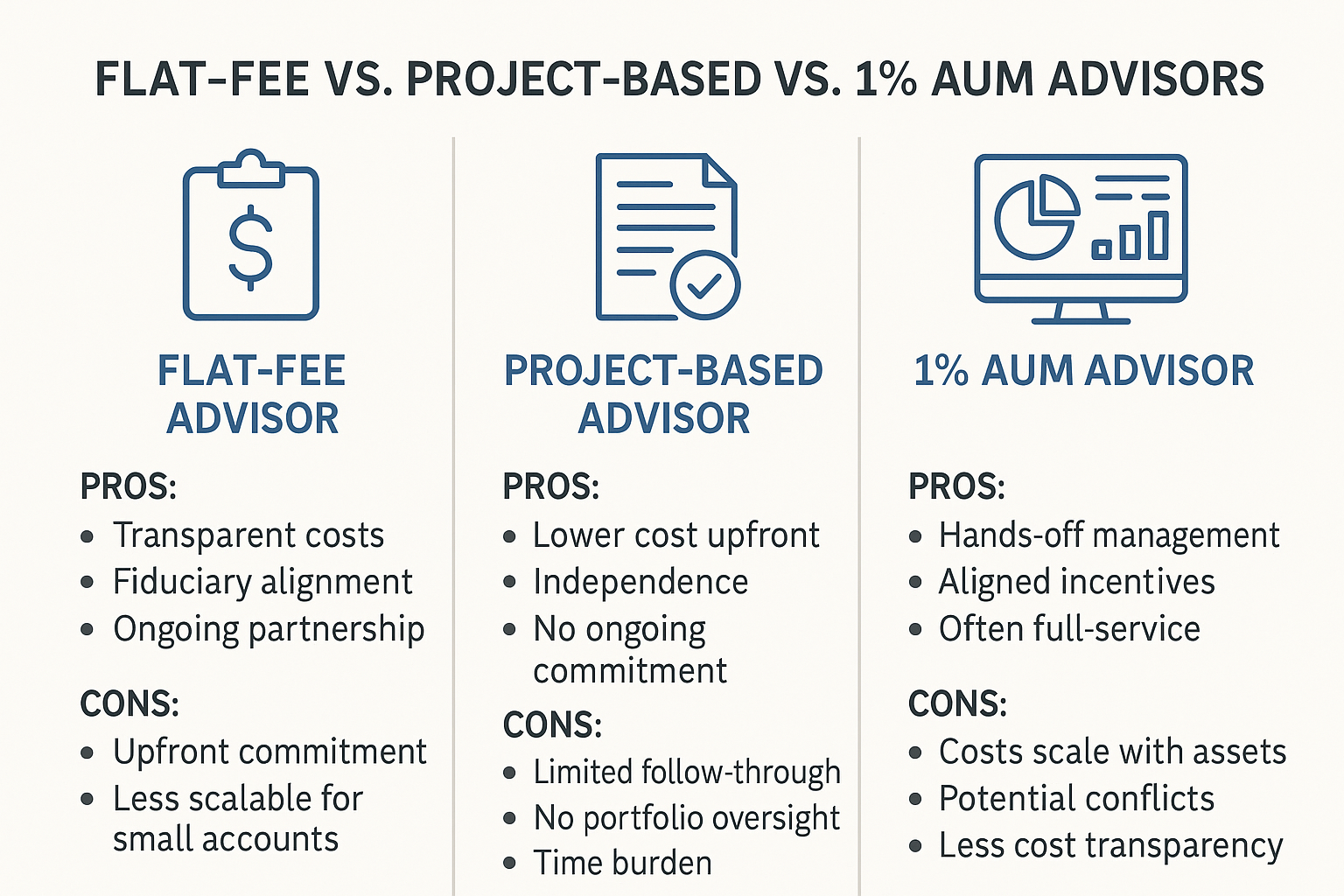

Flat-Fee vs. Project-Based vs. 1% AUM Advisors: Which Model Fits You Best?

Choosing a financial advisor can feel confusing—especially when each firm charges in a different way. Some charge a flat annual…

-

Don’t Overlook the Spousal IRA: A Retirement Savings Opportunity

What Is a Spousal IRA? A Spousal IRA allows a working spouse to contribute to an IRA on behalf of…

-

Financial Decisions Are About Trade-Offs—Not Right or Wrong

In financial planning, people often want to know: “Is this a good strategy?” The real answer? It depends. Our industry…

-

Managing Volatility in Retirement: Protecting Against Market Losses and Currency Debasement

Retirement can be the most rewarding chapter of your life — but it can also be the most financially vulnerable.…

-

Social Security Timing for Massachusetts Retirees: The Real Costs of Claiming Early vs. Waiting

For many retirees in Massachusetts — whether you live in Newton, Wellesley, Lexington, or along the South Shore — deciding…